China’s big leverage crackdown gets a big shrug from markets

The Chinese leadership has this year made its strongest commitment yet to curb financial risks and rein in spendthrift local officials, yet the campaign has spurred barely a ripple of concern among global investors.

In a recent survey, China hardly registered on the list of dangers eyed by fund managers and strategists that could threaten the “Goldilocks” boom in stocks and credit around the world. That’s a big change from two years ago, when a surprise devaluation of the yuan spooked markets, all the more because it came just weeks after China’s equity bubble had started to burst.

“If you look back at the last six, seven years, investors were always concerned about China,” said June Chua, a Hong Kong-based fund manager and head of Asian equities with Harvest Global Investments Ltd. “We’ve always had earnings that were on a constant downgrade. This time, this year, we’ve actually seen an upgrade cycle happening in China.”

Chua said she recently increased the weighting of Chinese shares in the international portfolios she helps manage. Harvest, with US$114 billion in assets under management, is one of the largest Chinese asset managers, though capital controls mean its overseas holdings are mainly for non-mainland China resident clients.

“The pressure is off,” said Jing Ulrich, vice chairman of Asia Pacific at JPMorgan Chase & Co. in Hong Kong. “We’ve seen China’s currency stabilise -- in fact it’s appreciated against the U.S. dollar this year. Also the foreign exchange reserves have stabilised.”

And with Chinese regulators increasingly opening the doors to domestic bond and equity markets, foreign investors have been gradually warming up to putting more funds into the country. Debt holdings reached a record even before the Bond Connect began last month, and jumped even further in July.

Not everyone is sanguine about China, though. Some point to vulnerabilities beyond the Communist Party’s leadership gathering expected for the autumn, especially if policy makers aren’t able to finesse an orderly deleveraging process. The authorities’ unpredictable past actions, such as diving in to halt the stock bubble’s bursting in 2015, and the occasional sudden cash squeezes in domestic money markets still cast a shadow for some overseas investors -- along with continuing concerns about transparency and accounting standards.

“As the dollar begins to stabilise over the second half of the year, the fault-lines which run through the Chinese economy are likely to become increasingly evident once again,” said John-Paul Smith, London-based emerging-market strategist at Ecstrat Ltd., a research firm. “We continue to believe that the biggest threat to the equanimity of global markets over the second half of this year comes from the prospects of instability in China’s economy and financial markets.”

But that’s not what most global fund managers think will trigger the next bear market -- read more here on their take.

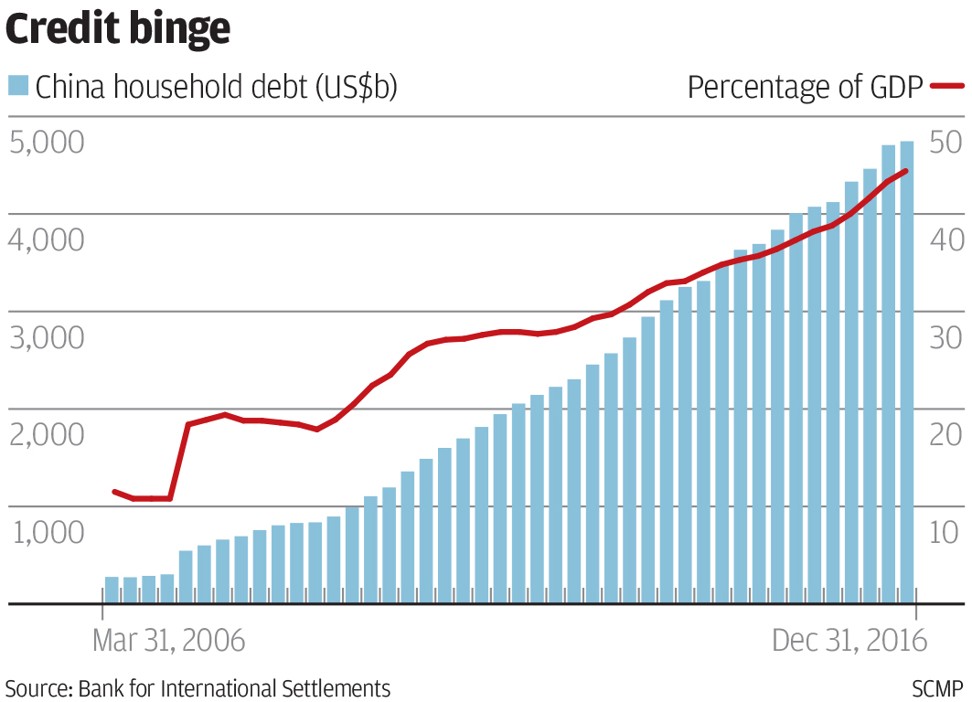

For the bulls, China’s economic data are cooperating for now, with indicators from the manufacturing sector to retail sales and fixed asset investment, all topping expectations. And looking out over the next two years, economists still anticipate growth in excess of 6 per cent, a pace that would give policy makers cushion to deal with the debt mountain.