The earnings that you can take out of the business every year without affecting its competitive position is called as Owner Earnings. I wrote about it in detail here. This term was coined by Warren Buffet and the formula for calculating it is given below. The capital expenditure (capex) he refers to is maintenance capex and not growth capex. But how do we know the maintenance capex? If an investor knows the business very well then he might. But it is an elusive concept which requires too much judgment for most of the investors. For calculating the maintenance capex, I used to depend on the management. Most of the times they wont reveal it and the only choice I had was to use the deprecation reported in the income statement.

Owner Earnings =

reported earnings plus (A) +

depreciation, depletion, amortization, and certain other non-cash charges (B) -

average annual amount of capitalized expenditures (C)

A + B - C

Wise men used to say that it’s not the book you start with, it’s the book that book leads you to. This statement came out to be true when I accidentally discovered Bruce Greenwald’s fantastic book. In it he explains how to calculate the maintenance capex.

Companies generally report capital expenditures in their statement of cash flows. We assume that each year, a part of this outlay supports the business at its sales level for the prior year, and part is needed for whatever increase in sales it has achieved. Companies generally have a stable relationship between the level of sales and the amount of plant, property, and equipment (PPE), net of depreciation, that they report. We calculate the ratio of PPE to sales for each of the five prior years and find the average. We use this to indicate the dollars of PPE it takes to support each dollar of sales. We then multiply this ratio by the growth (or decrease) in sales dollars the company has achieved in the current year. The result of that calculation is growth capex. We then subtract it from total capex to arrive at maintenance capex.

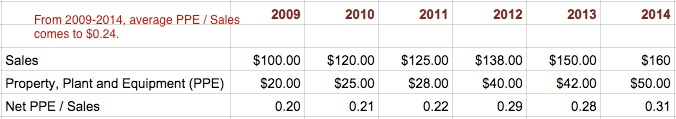

Let’s apply Greenwald’s method to calculate maintenance capex for the year 2014. Sales and PPE data for the company I made up is given below.

Step 1: The ratio of PPE-to-Sales shows how much needs to be invested in PPE for generating $1 of sales. In 2009 the company needed $20 in PPE for generating $100 in sales. This means it needs $0.20 in PPE for generating $1 in sales ($20.00 / 100.00). The average PPE-to-Sales from 2009 to 2013 comes to $0.24. Why average instead of last year’s ratio? Average normalizes peaks-and-troughs and our calculations will be less prone to distortions caused by business cycles.

Step 2: In 2014 the company increased its sales by $10 ($160 – 150) and its total capital expenditure increased by $8 ($50 – 42). In Step 1 we calculated that for generating $1 of sales the company on average needs $0.24 in PPE. For generating $10 of additional sales the company needs $2.40 ($10 * 0.24) in PPE which is the growth capex.

Step 3: Subtracting growth capex of $2.40 from total capex of $8 we get the maintainence capex of $5.60.

Bruce Greenwald is an amazing teacher and I would highly recommend you to read his book and watch his lectures

Good article. However there are a lot of caveats. If there has been a cyclical upswing during the last 5 years then the company had far more sales compared to ppe. Based on the good sales numbers if the company had some capex which has only now started to come online, and if the commodity cycle is now reversing, then the calculations go for a toss because now it will have poor sales and depreciation will be very high. Bottom line is that one needs to really factor in the cycles. One way I do this is by taking the ppe to sales of competition into account also. If the company’s numbers are far different than the competition’s then you have to adjust.

Also, this depends on the industry, some industries like the service sector essentially have no correlation between depreciation and sales.

Shan,

Thanks and you have a valid point. In cases where a company spends a lot of money in green field expansion and sales doesn’t show up immediately then growth capex will be very low to begin with and then shots up later. This method is not foolproof and one need to use their judgement to handle these exceptional cases.

Regards,

Jana

Hi Jana

Great insightful article

NET PPE / Sales = 1/Fixed Asset Turnover Ratio

Can we use it???

Thanks

Vinamra,

Yes.

Regards,

Jana

Hi Jana,

I struggled with the same concept many years back when I read this book of Prof. Greenwald. Even though it comes out as a reasonable method in theory, its application in practice is not as straight forward. With the benefit of applying the concept and practicing it numerous times, for the benefit of your readers, I just wanted to discuss some type of companies where I use to make lot of adjustments:

a. The companies where you will have the problem coming will be: Companies which have recently done a lot of capex but the growth from that capex is yet to come (not reflected in sales, also leading to huge operating leverage).

b. Cyclical Companies: Downturn in a cyclical industry which usually gets to see the most capex happening in the later years of the cycle than the earlier years.

c. Revaluation and Writeoff of assets on the books often lead to faulty numbers.

But despite all the issues, it probably the best available method (if one doesn’t like ‘Depreciation, which in itself is not ‘that’ faulty an assumption too).

Well explained article. Cheers !!!

Puneet,

Thanks a lot for your valuable comments. All your points are valid.

Regards,

Jana

Based on the comments and my experience, I guess it finally boils down to your “Circle of Competence”. If we know the industry well or if we have tried to understand it well, then using judgement and experience, we can put an approximation on it. And this is indeed required, else we might miss out on good opportunities if we mistake the Depreciation figure for Maint Capex – especially for greenfield expansions (as you rightly said)

Sometimes, I try to get an idea from the “Repairs” line item in expenses and it has helped.

Parvinw,

Thanks and yes you’re right and one needs to apply their judgment on top of what the ratios tell.

Regards,

Jana

And yes, Prof. Greenwald’s lectures are extremely insightful!! There is this philosophy of investing (wisdom) hidden in almost every paragraph of the transcripts!

Hi Jana,

Thanks for sharing this. I have a few thoughts about maintainence capex and i think that maybe there is a logical flaw in the way it is being thought of.

Now as you wrote owner earnings are something that can be taken out of business without affecting its competitive position and that maintainence capex is something that only supports current sales and does not add value to future cash flows (intrinsic value)

Now let’s step into the shoes of a business leader of a software firm who wants to get more contracts (more sales), the ground reality is, unless he has a past track record of servicing a good number of clients successfully, chances are, however low he might quote, a sustainable growth in contracts will be achieved only if he has done well previously. Now to do that he spends maintainence capex ( a part of employee salaries) that go towards serving existing clients, this expense although only serves to support current sales but also actually is an attractor of more business ie: more sales by more contracts theeby adding to intrinsic value.

Let’s look at another example. I know there has been much debate about advertising expense being quasi capex and the point seems quite valid there too. A company spending money on advertising to stop sales from dropping is also actually taking care of future sales. This draws some parallels to Network Effects. The more people keep consuming your product or service the more are likely to come in future (think social proof) and when we are asking the question of where to draw the line of what is maintainence and what is growth, i think we are asking the wrong question altogether.

Shreyans,

Thanks for your valuable comments. There are two parts to valuing a firm (1) what’s is it worth if it does not grow (2) what’s it worth if it grows and is growth adding value. For (1) we want to exclude growth capex and capitalize owner’s earnings at cost-of-capital to derive the intrinsic value without growth. And for (2) we would discount the free cash flows after accounting for the entire capex. Growth adds value only when the company ROIC > Cost-of-capital.

Regards,

Jana

Very Nice article jana , it give lot of clarity

Thanks Giriraj.

Regards,

Jana

Sir,

This might be a stupid question but I would request you to humour me.

In accounting we are taught that Capex (or additions to PPE) = Closing PPE – Opening PPE + Depreciation for the year. This Capex/Additions to PPE will include both maintenance capex and growth capex. It represents the actual purchases made during the year.

On the other hand, in the above method we ignore the effect of depreciation i.e.: Capex = Closing PPE – Opening PPE.

Is the above only a simplistic example or should we not use the accounting method of capex while using this method to calculate maintenance capex?

Hi Janav

In the above example, say your growth capex had been $15 then maintenance capex would have been ($8-$15) = ($7)

This would mean company needs less to nothing capex to maintain its current operation and all the spending they are doing (growth capex) is to attract new investments? Ideally, we would like to have low maintenance capex right?

Thanks

amit

Amit,

Capex depends on the industry. Software companies like Google can grow its sales and profits without much spending on growth + maintenance capex. And they will spew out lots of free cash flows.

In general you’re right. Lesser maintenance capex is good. Why invest more money to stay at the same place.

Regards,

Jana

Hi Jana,

Sometimes when you look at the gross block to calculate fixed asset turnover ratio, the value of appreciation of land (which is usually a big expense) gets omitted. For example – If the land appreciation is very high then the fixed cost to be invested say in next 1 year for Capex becomes very high which in turn would distort the above ratios but the intrinsic value of the enterprise would not get affected (like Balmer Lawrie and BEML have less book value but the value of their land is very very high.).

Thanks

Kanv Garg

Kanv,

You’re right. The method is not foolproof and one has to use their judgment to adjust for exceptions.

Regards,

Jana

Hi Jana,

Curious – isn’t owner earnings more relevant for capital intensive businesses? Below a certain level of PPE/Sales, I wouldn’t think Owner earnings should be that different from reported profits (I’ve tested on selected IT/pharma companies – not enough to make a sweeping statement yet, so needs investigation). Furthermore, would you then use owner earnings when determining ROA, ROE or ROIC?

Sorry if this is a dumb question!Look forward to your posts, they’re really stimulating, especially on behavioral biases – its a learning experience! Thanks!

GM00,

Owner’s earnings deals with several kinds of adjustments including how to handle “Non recurring expenses” that are recurring in nature. An excellent discussion on how to handle this is given in Greenwald’s excellent book: http://goo.gl/I9VUvD. So it should be applied to all types of business including IT & Pharma companies.

I look at owners earnings (after tax) to see the “earning power” of the company. And one can use it to calculate ROIC and other ratios.

Regards,

Jana

Thanks, Jana, for the response!

This could be another stupid question:

Why do we not consider change in working capital while calculating owner earnings?

The formula is:

Owner Earnings =

reported earnings plus (A) +

depreciation, depletion, amortization, and certain other non-cash charges (B) –

average annual amount of capitalized expenditures (C)

A + B – C

Why is it not:

Owner Earnings =

reported earnings plus (A) +

depreciation, depletion, amortization, and certain other non-cash charges (B) –

average annual amount of capitalized expenditures (C) –

Change in working capital (D)

A + B – C – D

Regards,

Nikhil

Nikhil,

The assumption here is that for maintaing the current level of sales we don’t need additional investment in working capital. Hence we don’t subtract it.

Regards,

Jana

Hi Jana,

Great Article, I wanted to know if you calculate PPE after/before depreciation? Also in the earlier comments you spoke about calculating ROIC using maintenance capex. How do you do that?

Anand,

PPE after depreciation. I meant [ Owner’s earnings / ROIC ]. If you’re comparing different companies then use pre-tax earnings as taxes might be different temporarily for several reasons.

Regards,

Jana

Great article, Thanks.

Jana,

In a literal sense , in a case like wonderla, where on an average you need 2 times of capex to generate 1 time sales, your growth capex will exceed the accounted total capex, and intern balloon your owners earnings. I just feel its key to understand when such growth capex will fructify, if in case it fructifies

2013 2014 2015

Total Capex 37 27 20

Growth capex 50 22 47

Maintenece Capex -13 5 -27

And in a business like wonderla, you can safely assume a decent amount of maintenance capex

Hi Jana,

As a solution for being a step more accurate to your formula, we could actually use the capacity utilisation rate , i.e (PPE * Capacity utilisation rate) to compensate the distortion of higher capex done by the company in a particular year/years.

It may not be accurate however it may help us getting closer to an answer without being materially distort

Do leave your comment

Jana,

do we need to take PPE from cash flow or Balance sheet?

Regards,

Vishal

Vishal,

Balance Sheet.

Regards,

Jana

Thank You.

Hi Jana,

Thanks for the great article. When you calculate the value of PPE from the Balance Sheet what all do you add?

Tangible Assets + Intangible Assets + Capital Work in Progress. Do you add the CWIP also since it does not really contribute to sales in that specific year.