Should You Buy William Hill Now?

The UK government is reportedly evaluating a proposal launched by the ministers to review the terms and conditions for TV advertising for gambling companies. If the government honors this request, it could result in a substantial decline in revenues and profits for gambling companies in the country.

According to reports, “Government ministers have ordered a review of ‘crack cocaine’ fixed odd betting terminals, which are said to be responsible for at least two suicides. The review is also looking at the advertising of betting sites on TV, which is wall-to-wall in Premiership matches.” And now, investors are already readying themselves for a scenario that Prime Minister, Theresa May, may act on this in the near future.

This could result in significant stock price declines in the gambling industry, which means that opportunities for long-term plays in the market may be limited. Given the current scenario, it appears as though most of the stocks in the gambling segment may be slightly overvalued as the immediate future remains uncertain for TV adverts.

However, when you sift through, you will realize that some stocks in the industry might actually be still attractive relative to their peers and the overall market outlook.

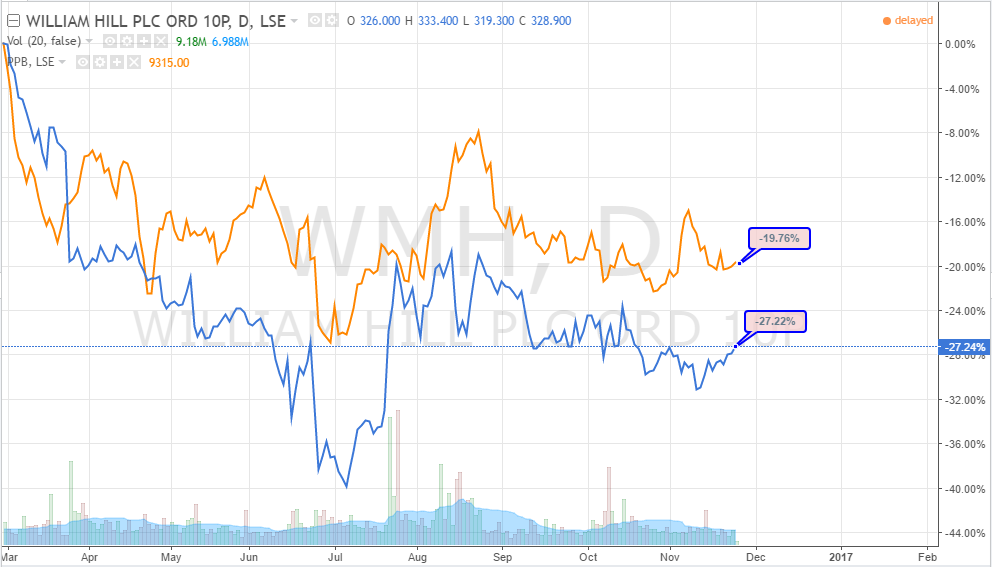

For instance, William Hill, which recently pulled out of a merger deal with Canadian online gaming company Amaya, offers an interesting value proposition given the current circumstances. Shares of William Hill are down more than 27% since February whereas those of the industry leading counterpart, Paddy Power Betfair, have declined just about 20% over the same period. William Hill is looking to explore more opportunities as it looks to augment revenues generated from gambling shops. Some of the areas include online gaming and mobile casinos, which offer among other gambling services, video poker, slots, and Roulette.

The two stocks were locked at the same levels in late February, in late April, and again in late July, but as demonstrated in the chart above, their return levels have not locked horns again since then and for the last three months, they have maintained parallel trends.

However, while the seven percentage points gap in returns may suggest that William Hill may have some catching up to do and thus a higher potential for an upward movement, that’s not what actually makes it more attractive than its counterpart.

Following the company’s recent quarter results, William Hill‘s P/E ratio for the trailing 12-month period has improved greatly currently standing at just under 12X whereas that of counterpart Paddy Power Betfair is pegged at about 30X.

In addition to that, William Hill boasts a healthy dividend yield of 4.18% compared to Paddy Power Betfair’s 2.07% yield. Again, this hands an advantage to the London-based bookie and more importantly, it is an added incentive to investors as they analyze the current market conditions in the gambling industry and the potential investment opportunities.

While William Hill may have pulled out of the Amaya merger, the gambling industry is no doubt set for a continuous consolidation. This is mainly because various governments including the UK government continue to tighten operating conditions in a bid to curb addiction amongst gamblers.

Gambling companies also continue to explore more opportunities abroad and in alternative markets in a bid to diversifying their risks.

Given the current advances in technology and the changing consumer behavior, it’s pretty clear that most people are spending a lot of time using smart devices including phones, tablets, and watches. The gambling industry players have noticed this trend and are now trying to adapt to the changing times. As such, they are developing gambling platforms that are targeting this group of people.

William Hill has made it clear that it intends to take the opportunity and is already looking to challenge Paddy Power Betfair’s market dominance through strategic M&As. Its recent attempt to merge with online gaming giant Amaya is a good example that the company is fully committed to exploring opportunities in alternative markets both geographically and service-wise.

This makes the company’s outlook interesting even given the impending changes in the business environment, especially in the UK.

Now, from a technical perspective, shares of William Hill appear particularly attractive based on the current trend.

As shown in the chart below, William Hill‘s stock recently crossed the 50-Day SMA and it now looks set for the 200-Day SMA target.

If the shares of the company continue on this trend, it would be realistic to set a 3-month price target of 315 pence a share, which is the current 200-Day SMA level.

Conclusion

In summary, the UK Gambling market could be struck with an adverse regulatory policy in the coming months barely a couple of years since the government tweaked the taxation rules to apply 15% tax on all gambling revenues earned in the country.

This will definitely have a negative impact on revenues and profits, but companies like William Hill appear to have an interesting value proposition in spite of the market conditions.

Disclosure: The material appearing on this article is based on data and information from sources I believe to be accurate and reliable. However, the material is not guaranteed as to accuracy nor does ...

more