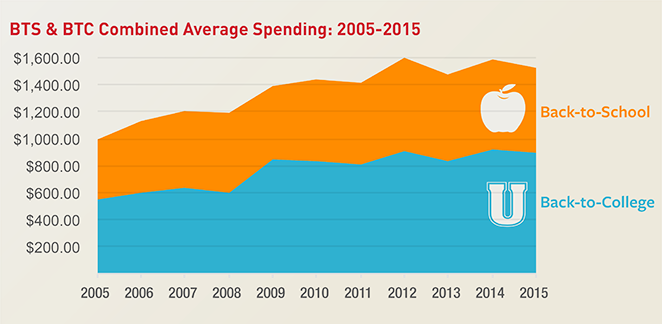

Average Spending on Back to School Has Grown 42 Percent in Past 10 Years

WASHINGTON, 2015-7-15 — /EPR Retail News/ — After spending more on school supplies and electronics in 2014, parents this year will head into the back-to-school season evaluating what their children really need before spending on new items. According to NRF’s Back-to-School Spending Survey conducted by Prosper Insights & Analytics, the average family with children in grades K-12 plans to spend $630.36 on electronics, apparel and other school needs, down from $669.28 last year. Total spending is expected to reach $24.9 billion. Additionally, indicating the continued growth in the back-to-school arena, families on average have spent 42 percent more on school items over the past 10 years.

Total spending for K-12 and college is expected to reach $68 billion.*

Back-to-School 2015 Cheat Sheet from National Retail Federation

Regardless of the slight decrease, survey results point to a more confident consumer when it comes to spending and the impact of the economy. The survey found 76.4 percent of families with school-age children say they will change their spending because of the economy, the lowest in the seven years NRF has been tracking it, and down from 81.1 percent last year.

“As seen over the last 13 years, spending on ‘back to school’ has consistently fluctuated based on children’s needs each year, and it’s unlikely most families would need to restock and replenish apparel, electronics and supplies every year,” said NRF President and CEO Matthew Shay. “Parents this summer will inventory their children’s school supplies and decide what is needed and what can be reused, which just makes good budgeting sense for families with growing children.”

“Heading into the second half of the year, we are optimistic that economic growth and consumer spending will improve after a shaky first half of the year,” said Shay.

As Economy Improves, Impact on Spending Lessen

Solid growth in job creation and consumer confidence have greatly contributed to the economic recovery, which could be positively impacting how families shop for school items this year. The survey found 40.6 percent of those who say the economy is impacting their spending plans will look for sales more often, down from the 46.2 percent last year and the lowest since NRF began tracking this in 2009. Additionally, 29.8 percent will buy more generic or store brand products, down from 34 percent last year and another survey low.

For those who have to restock what their children need for school, 92.7 percent will purchase new apparel, spending an average of $217.82, though most (94.1 percent) will head out for new school supplies, spending an average of $97.74; families will also spend $117.56 on new shoes.

In 2014, 58.3 percent of parents said they would buy electronics for their school-age children, and planned to spend an average of $212.35 — one of the highest amounts seen in the survey’s history. Having less of a need for electronics this year, however, families said they would decrease their spending on gadgets for their children and will spend an average of $197.24.

Source: 2015 NRF Back to School/College Spending Survey conducted by Prosper Insights & Analytics.

More families with children in grades K-12 are opting to wait before rushing out to shop. According to the survey, 19.6 percent will shop at least two months before school, down from 22.5 percent last year. Starting a little later this year, two in five (42.8 percent) will shop at least three weeks to one month before school, down slightly from 44.5 percent last year. More families (30.3 percent) will shop one to two weeks before school, up from 25.4 percent last year.When asked why they begin shopping for back to school at least two months out, 64.9 percent said they shop early to spread out their budgets, and half (51.1 percent) do so to avoid crowds associated with school shopping. Other popular reasons include not wanting to miss out on popular merchandise (21.5 percent) and prices and promotions being too good to pass up (45.3 percent).Planning to shop around for their school merchandise, families will head to their local department (56.4 percent), discount (62.2 percent), clothing (53.5 percent), electronics (22.4 percent) and office supply stores (35.9 percent). And slightly more than one-third (35.6 percent) of those looking for school items will shop online.

For the first time, NRF asked about shoppers’ intentions to use retailers’ omnichannel offerings; of those planning to shop online, nearly half (48.4 percent) say they will take advantage of retailers’ buy online, pick up in store or ship to store options, and 17.3 percent will look for expedited shipping offers. Nine in 10 (92.1 percent) will take advantage of retailers’ free shipping offers.

“Savvy and budget-conscious parents today have plenty of experience when it comes to looking around for great deals and value-add promotions, and it seems mom and dad will use that to their advantage this summer to take advantage of retailers’ omnichannel services,” said Prosper’s Principal Analyst Pam Goodfellow. “To ease hectic schedules and long shopping lists, it’s likely that we’ll continue to see consumers try out and regularly use services like free shipping, reserve online and even same-day delivery — options busy parents have been waiting for.”

Broken out by age, Millennials are much more likely to use these channels: Two-thirds of 18-24- and 25-34-year-olds will use a buy online, pick up in store or ship to store option (65.7 percent and 65 percent respectively), and 15.4 percent of 25-34-year-olds will use a reserve online option, much higher than the 9.1 percent of average adults who plan to do so. Additionally, 23 percent of 18-24-year-olds will use same-day delivery, significantly more than the 10.2 percent of average adults.

Three-quarters Say Half of What they Buy for School is Influenced by Children

Fashion-forward teens and tweens know just how to get mom and dad’s attention when it comes to new school gear to make their friends stop and stare. According to the survey, 86.4 percent of school shoppers say their children will influence one-quarter or more of their back-to-school purchases. And for the smaller purchases, children plan to chip in some of their own money; teens will dole out $33.27, and pre-teens will spend an average $17.57.

LIKE THEIR YOUNGER COUNTERPARTS, COLLEGE SHOPPERS SPENDING LESS IN 2015

Trendy Millennials Drive Dorm Furnishing Spending Up 30 Percent in 2015

As seen in NRF’s Back-to-School Survey, college shoppers and their families will also spend slightly less this year after investing in electronics and supplies in 2014. According to NRF’s 2015 Back-to-College Spending Survey, families with children in college and college students will spend an average of $899.18, down slightly from $916.48 last year. Total spending is expected to reach $43.1 billion.*

Combined spending for school and college will reach $68 billion.

“As we see with back-to-school spending, there are also seasonal shifts in the college arena as well, and it’s important to remember that spending on school and college is not indicative of future spending trends, especially the holiday season,” said Shay. “That said, we’re still seeing a very confident college shopper. We fully expect families to take advantage of retailers’ unique promotions on home furnishing items, apparel and even electronics, while still reusing what they can in good frugal fashion.”

After spending significantly more on electronics last year, the average person shopping for electronics will spend $207.27, down from $243.79. Families with college students and students themselves will spend $136.95 on apparel, $117.98 on food items to stock their dorms and apartments, $66.70 on school supplies, $72.79 on shoes and $78.02 on personal care items.

Trendy Millennials have changed how they view the décor needs for their traditionally less-than-appealing dorm rooms, and this year spending on matching bed sets, curtains, bath linens and other home goods will top any previous year. According to the survey, half (51.3 percent) of college shoppers will purchase dorm or apartment furnishings and will spend an average $126.30, up 30 percent from $96.70 last year and the most since NRF began tracking it in 2007.

Mirroring the growth in spending on dorm furnishings, more college students are planning to live in a dorm room or college housing. According to the survey, 31.3 percent will live in a dorm or college housing, up from 23.9 percent last year. Additionally, 21 percent will live in off-campus housing and 41.5 percent will live at home, down from 46.8 percent last year.

About the survey

NRF’s 2015 Back-to-School and Back-to-College spending Surveys were designed to gauge consumer behavior and shopping trends related to back-to-school spending and back-to-college spending. The surveys were conducted for NRF by Prosper Insights & Analytics. The poll of 6,500 consumers was conducted June 30-July 8, 2015.The consumer polls have a margin of error of plus or minus 1.2 percentage points.

Prosper Insights & Analytics delivers executives timely, consumer-centric insights from multiple sources. As a comprehensive resource of information, Prosper represents the voice of the consumer and provides knowledge to marketers regarding consumer views on the economy, personal finance, retail, lifestyle, media and domestic and world issues. www.ProsperDiscovery.com

NRF is the world’s largest retail trade association, representing discount and department stores, home goods and specialty stores, Main Street merchants, grocers, wholesalers, chain restaurants and Internet retailers from the United States and more than 45 countries. Retail is the nation’s largest private sector employer, supporting one in four U.S. jobs — 42 million working Americans. Contributing $2.6 trillion to annual GDP, retail is a daily barometer for the nation’s economy. NRF’s This is Retail campaign highlights the industry’s opportunities for life-long careers, how retailers strengthen communities, and the critical role that retail plays in driving innovation. NRF.com

* The total spending figure is an extrapolation of U.S. adults 18 and older.

Kathy Grannis Allen

(202) 783-7971

press@nrf.com

(855) NRF-Press