This Chinese stock was more actively traded than JPMorgan, but hardly anyone’s heard of it

For reasons unknown, the shares of Fangda Carbon New Material are suddenly in demand, making it the world’s 11th most-traded stock in the world on Friday, beating JPMorgan Chase & Co.

Fangda Carbon New Material Co. isn’t typically a name that jumps to mind when one thinks of the world’s most-actively traded stocks.

Yet for reasons unknown, shares of this obscure Chinese maker of graphite electrodes are suddenly changing hands at a pace usually reserved for the global equity market’s crème de la crème.

On Friday, Fangda Carbon was the 11th most-traded common stock in the world, despite a middling US$8.4 billion market capitalization that failed to crack the global top 1,500. Its turnover exceeded that of JPMorgan Chase & Co., which has a market value of US$331 billion, and came within striking distance of Microsoft Corp., a US$558 billion behemoth.

The flurry of activity, which coincided with a nearly 200 per cent rally in Fangda Carbon’s shares since late June, is all the more extraordinary given the sleepy state of China’s stock exchanges this year. Volatility readings in the $7.1 trillion market are near the lowest levels since the early 1990s, while turnover has dropped about 80 per cent from peak levels in 2015.

Unsurprisingly, Chinese authorities have taken notice. Shanghai’s stock exchange issued written warnings to some investors after observing unusual trading behaviour in Fangda Carbon last week, according to people familiar with the matter.

Regulators are on high alert for suspicious trading activity in the world’s second-biggest stock market after Liu Shiyu, chairman of China’s securities watchdog, vowed to crack down on misbehaviour in the wake of a US$5 trillion equity crash two years ago. The CSRC collected 6.4 billion yuan (US$955 million) in penalties from market participants in the first six months of the year, exceeding the total from all of 2016.

The Shanghai exchange didn’t reply to a request for comment. Fangda’s board secretary and securities department representative didn’t answer calls.

Some of the stock’s recent gains may have been driven by the company’s July 24 announcement that preliminary first-half net income surged 26-fold. Still, the earnings release doesn’t explain why shares jumped before the results were made public, nor does it make clear why the surge in volume lasted so long. Instead of dissipating in the days after Fangda Carbon’s announcement, turnover kept rising through Friday.

That trading session was particularly volatile. After climbing as much as 8.9 per cent, the stock tumbled suddenly in the final hour of trading to close with a 7.1 per cent loss. A record 10.3 billion yuan of shares changed hands, up from the 914 million yuan average over the past year. While the broader market experienced a similar price reversal, its move was much more subdued. The Shanghai Composite Index ended Friday with a drop of 0.3 per cent.

In its written warning, the Shanghai Stock Exchange said it would take disciplinary action if the unusual trading in Fangda Carbon persists. Steps the exchange might take include restricting certain investors’ accounts or labelling them as unqualified investors, said the people, who asked not to be named because the information isn’t public. Brokerages were ordered by the bourse to closely monitor transactions in the related accounts, the people said.

Fangda Carbon shares declined 3.8 per cent Tuesday, while the Shanghai Composite edged up 0.1 per cent.

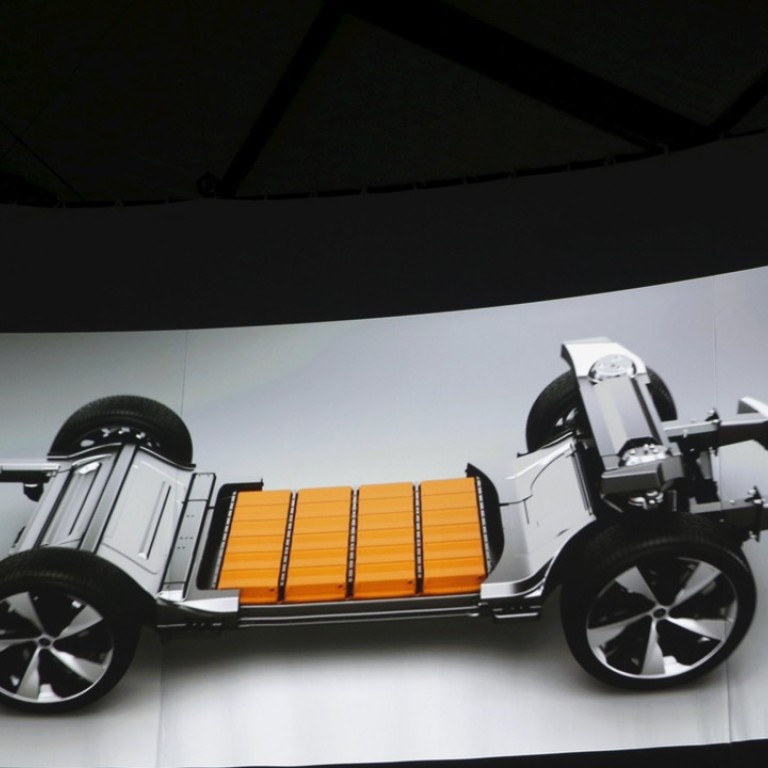

It’s possible that the company has become a target of speculative traders because its products can be used to help charge electric car batteries, a technology that’s gotten a boost from Chinese government subsidies, according to Yin Ming, vice president of Shanghai-based investment firm Baptized Capital. He said such trading frenzies are common in China, where individual investors drive more than 80 per cent of volume on local stock exchanges.

Data from China’s cross-border exchange link shows overseas investors joined in on the action, too. Fangda Carbon was among the 10 most-actively traded shares through the Shanghai-Hong Kong market link on Friday, putting it in the same league as financial giant Ping An Insurance Group Co. and premium liquor producer Kweichow Moutai Co.

“The rally is more due to speculative buying,” Yin said. “The small market cap just makes it a perfect target.”