Britain's leading business group has for the first time admitted that "black box" tax schemes devised with the sole aim of avoiding tax are unjustifiable even if they are legal.

Hitting back at critics who accuse large companies of using underhand tactics to avoid paying tax, the CBI said its members play by the rules and pay their fair share of tax. In a document called Tax and British Business – Making the Case, the CBI attempts to explain how businesses legitimately limit the amount of tax they pay without resorting to complex tax avoidance schemes. It uses international comparisons to argue that UK firms pay more than their counterparts in Germany, France and the US after tax breaks and reliefs are considered.

UK Uncut and other anti-poverty campaign groups have become increasingly vocal in calling for a crackdown on artificial tax planning by big business. But the CBI director general, John Cridland, said business underpinned "the majority of tax revenue collected by the government" and that it was a mistake to tar most employers with rogue firms that push the limits of tax avoidance.

The defence of business tax contributions is likely to prove controversial as the chancellor, George Osborne, cuts corporation tax to 22% from 26%. The CBI has stated that it aspires to a rate of 18%, which would be the lowest in the G20.

Critics of tax strategies by large firms have focused in recent years on arrangements between Vodafone and HM Revenue & Customs that saved the telecoms firm £7bn. A deal with Goldman Sachs allowed the US investment bank to sidestep at least £10m in tax on senior staff bonuses.

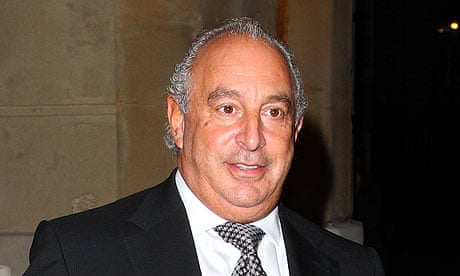

UK Uncut has also targeted business people including Sir Philip Green, whose retail group Arcadia includes Top Shop and Miss Selfridge and who has avoided UK tax on dividends paid to himself and his wife in Monaco.

The TUC's Tax Gap report, by Richard Murphy, argued that businesses avoided at least £12bn tax a year through sophisticated tax planning and offshoring of profits. Murphy said in the 2008 report that his calculations showed firms had an effective tax rate of 22.5%.

Cridland said most businesses enjoyed tax reliefs on research and development and capital purchases, which were encouraged by the government.

"Business should not engage in abusive tax arrangements. However, in running their normal day-to-day activities, as well as in commercial transactions large and small, businesses need to manage their tax affairs as a key part in operating their businesses," he said.

Cridland said business had proved reluctant to talk about tax in the past, but a combination of intense criticism of individual firms and the tax debate stirred by the government's austerity measures meant it was necessary for employers to engage more openly about the appropriate level of business taxes.

Most European countries have been investigating ways to limit taxes on business in response to cuts in headline corporation tax rates across the developed world, especially the 12.5% rate adopted by Ireland more than a decade ago.

President Barack Obama has signalled his intention to cut taxes on business, though in combination with increases in personal taxes on wealthy individuals.