With fierce China critic Peter Navarro off the Trump trip list, how will Beijing fare in trade talks?

The man once described as Trump’s most powerful economist has been sidelined in favour of ‘more pragmatic and realistic’ China detractors

Peter Navarro, an outspoken China critic who has advocated a trade war with Beijing, is so far not on the list of Washington delegates travelling with US President Donald Trump this week on his first state visit to China.

But that does not necessarily mean Beijing will be in a better negotiating position in trade talks with the US, according to pundits.

What it does confirm is that the man once described as possibly the most powerful economist on Trump’s policy team has been sidelined for a while.

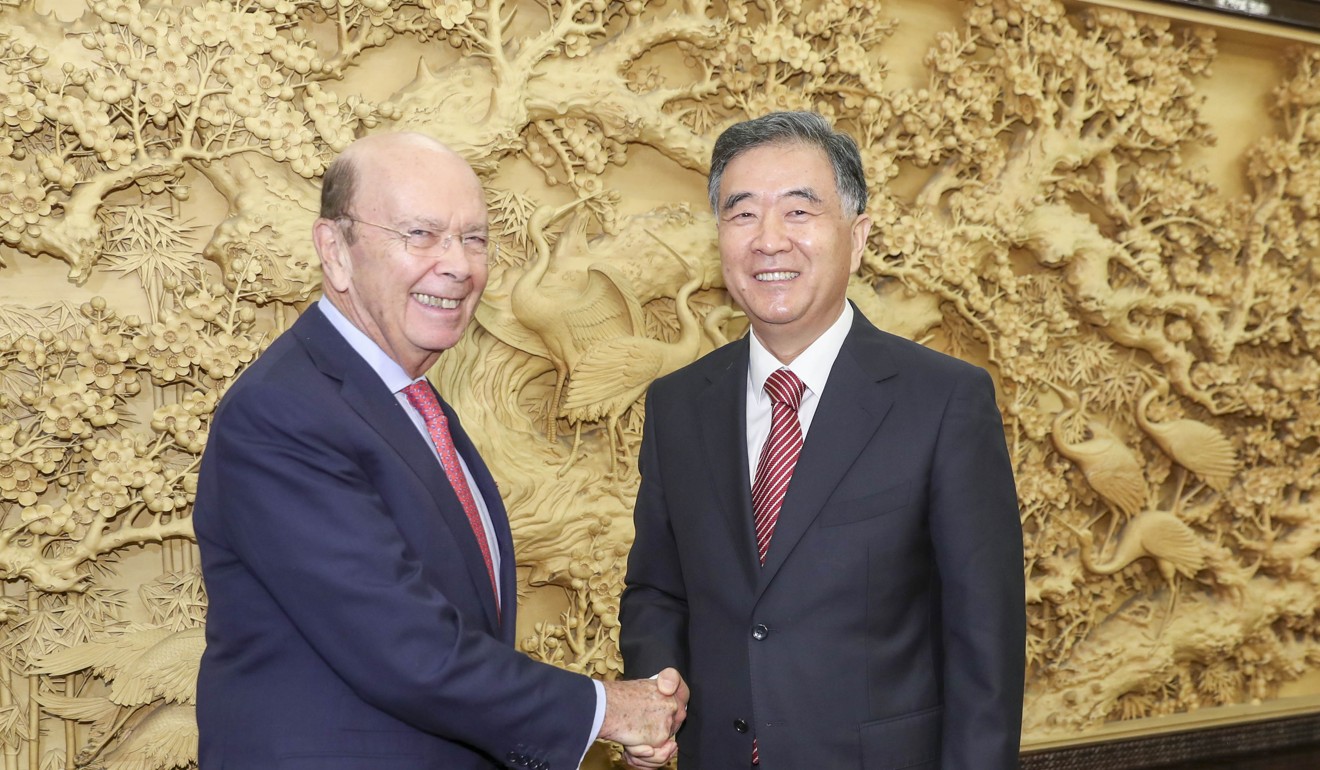

The key players in US economic policy with China – US Treasury Secretary Steve Mnuchin, Commerce Secretary Wilbur Ross and Trade Representative Robert Lighthizer – all “hold strong views against China, but they are more pragmatic and realistic” in handling economic issues with Beijing, according to a former US economic official who agreed to speak only on condition of anonymity.

Navarro was Trump’s economic adviser during last year’s US presidential election campaign. Known for books such as Death by China and The Coming China Wars, he has claimed China is stealing US jobs and has advocated draconian actions against Beijing, including a trade war.

He was appointed head of the White House National Trade Council during the presidential transition period. His new role raised concern in Beijing about the inevitability of further labelling of China as a currency manipulator and an accelerated trade confrontation with Washington.

But the influence of other more moderate, more sophisticated advisers outweighed Navarro’s when it came to setting up Trump’s China policy, observers said.

“He was sidelined. He was removed from the head of the council,” an American business lawyer said, refusing to be named. “He was given a very small office for revitalising manufacturing and had only one colleague with him.

“He ... didn’t offer anything substantive to the policymaking process.”

While Navarro’s detractors admitted there was a thread of truth in his theory, the way he made his case for the economy was seen as too aggressive. But his impact lingers.

“Despite his lost influence in policymaking, Navarro is still a card for Trump to play against China,” said Lu Xiang, a US expert with the Chinese Academy of Social Sciences.

The first meeting between Chinese President Xi Jinping and Trump at Mar-a-Lago on April 6 eased concerns on bilateral trade tension. The US Treasury Department did not label China a currency manipulator when it released a report a week later.

After the summit, in a 100-day plan to address the US trade deficit with China, a key issue for Trump’s China policy, both countries reached deals that included China’s imports of US gas and agricultural goods.

But the bromance only lasted three months. A Comprehensive Economic Dialogue ended in mid-July with the parties at an impasse. No substantial agreement on trade or investment has been announced since.

In August Trump authorised Lighthizer, who played tough in the 1980s in talks aimed at stemming the flow of imports into the US from Japan, to launch a probe into alleged Chinese intellectual property violations.

Cui Fan, a professor of international trade with the University of International Business and Economics, said the probe, known as the “301 investigation”, might be used by Trump as a negotiating tool against China during the visit.

In September, Ross pressed China to take meaningful action to address trade issues. Business representatives said the US, adjusting its China plan, now preferred to see real movement by China to fix the imbalance in bilateral trade ties before going back to the bargaining table.

Meanwhile the US Congress is considering strengthening the screening of foreign investment in US companies, especially from China.

Trade will be a top priority for Trump during the China visit, which will last from Wednesday to Friday. In addition to reaching concrete deals, the US business community also hopes Trump can pressure China to open up its market to US investors to ensure a level playing field.

William Zarit, chairman of the American Chamber of Commerce in China, said the US administration had some staff “who are very knowledgeable and have long-time experience of work in China and have a pretty good sense of what’s going on”.

“China has approached economic relationships very strategically with a long-term view. We hope that the US administration will become strategic and have a long-term view,” he said.