22

Mar, 2017

22

Mar, 2017

Hold on To Your Wallets!

Surely, you all remember the organized and orchestrated opposition to IEX’s Exchange Application. HFT proponents joined the existing status quo stock exchanges in voicing opposition to the IEX’s slow calamitous speedbump. They all feared the innovations put in place into the free market by IEX. These innovations include:

- Providing a 350-microsecond speedbump (slowing everybody down equally)

- Providing free market data.

- NOT selling colocation.

- Providing Free Lit trading and no maker taker rebates.

- NOT providing individual order data, which would “leak”.

The above innovations have had the effect of not only lowering trading costs for all of us through increased spread capture; they have also lowered costs through lessened order leakage. Perhaps most importantly, we believe IEX becoming a protected quote has thrown a quite serious wrench into the “Three Tick Boogie” – a scandalous but observable pickoff move in stocks that takes place daily.

The point of today’s note is to point out that all those same pundits who organized to do the bidding of the status quo exchanges and high speed prop trading firms a year ago appear to be coming back, and we want you to have them all on your radar. Their rallying cry is now:

Eliminate the Order Protection Rule (OPR)!

They argue that Reg NMS’s Order Protection Rule (Rule 611), the rule that requires that all quotes at the NBBO be protected, is outdated, and should have never been approved. Here is an April 2015 memo from the SEC’s EMSAC on Rule 611.

Here is David Weisberger arguing that Rule 611 is so yesteryear, and akin to an inefficient box on old forms that indicated “the number of air raids that day”. He argues that Rule 611:

- Stifles innovation.

- Increased complexity and necessitated special order types.

- Is unnecessary – it increases spread costs.

- Exchanges don’t have monopoly power anymore.

- FINRA Best Ex guidelines will push brokers to “do the right thing” without a regulatory mandate to not sell stock for your client at 47 cents when there is a 50 cent bid.

We disagree with him on nearly every point. IEX, Aequitas, LEVL, and Luminex are all non-exhaustive and recent examples of innovation. The increased complexity came from for-profit exchanges inventing queue-jumping order types, speed-gaming mechanisms, and post-only conflict-of-interest absurdities – NOT the mandating of honoring a quote. Claiming that exchanges don’t have monopoly power any more is absurd. Look at the ransoms they are charging firms for data and connectivity, while those costs have come down in every other industry. And relying on brokers to “do the right thing”, well, we think you know the response to this one.

Don Ross, the new CEO of PDQ Enterprises argued in The Hill, a widely read political news source, that It’s Time For the SEC to Take a Hard Look at this Stock Market Rule. His argument acknowledges quote fading in its purest common form, and claims that having no order protection will get investors better prices with less complexity.

We will not be surprised if another well-known industry consultant weighs in next and completes the lobbying trifecta.

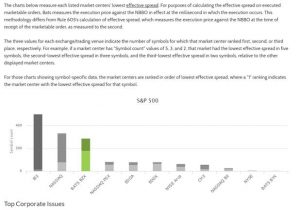

Don’t listen to these folks. They are talking their book, or their lobbying books. IEX is gaining traction, and is undoubtedly lowering our transaction costs for our clients. But don’t take our word for it; IEX competitor, BATS Global Markets, has this handy chart:

The HFT crowd wants their Three Tick Boogie back. If routing to clear out IEX at the quote has diminished their ability to do you harm, and their ability to push stocks around, they now want to lobby to eliminate the Order Protection Rule. They are taking advantage of an SEC regime change, with a new potential chief with an anti-regulation bent, and it is obvious. While their little small arguments and analogies might be considered cute to some, the damage they want to do to markets and investors is not.

We would caution the SEC not to chase the shiny object that the HFT crowd is now waving around. Rather we have a few suggestions of our own that can get rid of a lot of the noise and games that currently plague the equity market:

- Eliminate maker/taker and payment for order flow.

- Eliminate individual order exchange data feeds and instead use aggregated feeds by price level

We are by no means in favor of all the rules implemented by Reg NMS. In fact, our 2012 book “Broken Markets” singles out Reg NMS as the rule which caused many of the problems that have festered in the equity market. But the HFT community is trying to misdirect the fixes to this rule and they are doing it conveniently at the time that their cash machine seems to be ending.