Europe's Fail-Out: 4 Reasons Why Spain's Bailout Is Doomed Already

Time for Plan B. The Spanish bank bailout didn't even work for one day.

(Reuters)

Apparently, $125 billion billion doesn't buy much these days. Not even six hours of relief.

Over the weekend, Europe announced a bailout of Spain's ailing banks. It wasn't quite financial shock-and-awe, but €100 billion ($125 billion) seemed like an impressive enough sum to buy at least a few weeks -- or at worst a few days, right? -- of calm in the markets. It wasn't. If anything, things are getting worse faster in Europe. What's going on?

First, a quick recap. As Paul Krugman put it, Spain was Europe's Florida. It had a prodigious housing bubble. And now its cajas saving banks have a prodigious amount of bad real estate loans on their books. But the Spanish government can't afford to bail its banks out. It can't print euros, and it can't borrow euros, except at punitive rates. We have a word for this. That word is "broke".

But Spain resisted going to Germany for a bailout. Spain feared the austere terms Germany would likely impose as part of any deal. So Spain played a game of chicken. First, it tried to get the European Central Bank (ECB) to bail out its banks instead. Germany balked. Then, it threatened eurogeddon -- memorably saying that they would not be bullied because "Spain is not Uganda" -- if it didn't at least get better terms on its bailout.

At first, it looked like Spain had won. Europe announced that the €100 billion aid package for Spain's banks would come without any further conditionality. Translation: Spain would get the money without having to do any more austerity than it had already promised to do. But then things unraveled. And fast.

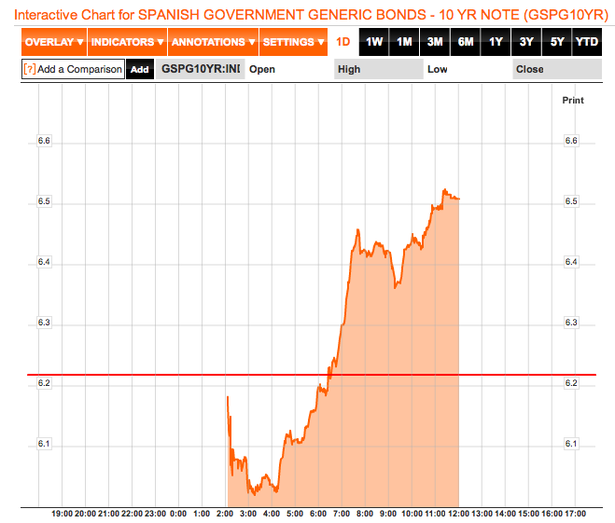

The chart below from Bloomberg shows Spain's 10-year borrowing costs. Remember, the point of the Spanish bank bailout is, in large part, to reduce yields on Spanish bonds to break up the doom loop between weak sovereigns and weak banks. About that....

After briefly retreating, Spanish borrowing costs surged above 6.5 percent. That's the market giving a vote of no-confidence for the bank bailout. But the bad news hasn't stopped there. The Spanish IBEX stock index gave away a 5.9 percent increase, and finished down on the day. Italian bonds got hammered too. So did the Italian FTSE MIB stock index.

Why did markets turn so quickly from gloom to doom? The short answer: Investors are worried the Spanish bank bailout might make things worse -- and with good reason. The devil is in the details, and the Europeans have been embarrassingly short on those. Here are the four big questions that remain to be answered.

1) What's the interest rate on the €100 billion loan to Spain?

This being Europe, the term "bailout" is a bit misleading. Germany isn't cutting a check for Spain. It's a loan. European officials have promised that the interest rate on this loan is well below what Spain can borrow in the markets -- it'd better be, or what would be the point? -- but they haven't said what that rate is. It's hard to judge how good a deal Spain is getting without knowing this.

2) How much will the bailout add to Spain's debt?

This being Europe, Spain's bank bailout has a slightly Byzantine structure. The bailout funds will go to Spain's so-called Fund for Orderly Recapitalization of Banks (FROB) -- a government agency that will then inject the money into struggling banks. The Spanish government, however, backstops the FROB.

But this being Europe, this financial legerdemain doesn't really matter. The Spanish government is ultimately on the hook, full stop. So the bank "bailout" will add roughly 10 percentage points to Spain's public debt-to-GDP ratio, assuming growth doesn't collapse further. That's a big assumption.

3) Will the bailout loan be senior to other debt?

This being Europe, there are two bailout funds. There's the soon-to-be defunct European Financial Stability Facility (EFSF) and the soon-to-be online European Stability Mechanism (ESM). Spoiler alert: They're supposed to increase ... stability. They haven't exactly succeeded.

This being Europe, it actually matters a great deal whether the EFSF or the ESM loans the money to Spain. The ESM is senior to all other creditors, after the IMF. The EFSF isn't. In plain English, an ESM loan increases the odds that private bondholders will take a loss if Spain ever restructures its debt. An EFSF loan doesn't. So private investors will demand higher interest rates on Spanish bonds to compensate for the higher risk of losses if the money comes from the ESM. That's precisely what happened on Monday after European officials announced that it would indeed be the ESM making the loans.

But this being Europe, they subsequently reversed themselves. They said that the money might come from the EFSF instead -- at least at first. In the long run, it's unclear how much this would even matter. In the short run, Spain is still on the hook as a partial guarantor of EFSF loans. Um, what? The EFSF works by issuing bonds backstopped by Europe's healthy economies. But Spain can't get out of its commitment as a guarantor because its government technically isn't getting bailed out. Its banks are. So Spain would be guaranteeing a loan it's taking out. That makes even less sense than you think.

4) Will the bank bailout come with new strings attached?

This being Europe, it's not too surprising that the initial headlines that Spain was getting this money unconditionally might not be true. On Monday, German officials said that the so-called Troika of the EC, ECB, and IMF would "supervise" the bailout -- which is eurospeak for imposing more austere austerity. Still, it's unclear what this means. It's possible the Germans were talking about a previously announced agreement where European officials will reform Spain's sclerotic financial sector. But it's also possible that they were talking about further spending cuts and tax hikes.

This being Europe, it's almost impossible to say. But it's another reason for markets to worry. Troika reforms in Greece, Portugal and Ireland have knee-capped growth. And a country that can't print its own money can't pay back its debts when it's not growing. It creates self-fulfilling doubts about its solvency. It's just another reason for investors to push up the yields on Spanish debt.

***

There's a simple way to tell if the Spanish bank bailout is working. Look at Spanish borrowing costs. If they're falling, it's working. If they're not, it's not. By that metric, the 48-hour old bailout is already a clear failure.

It's easy to understand why. The bailout will increase Spain's debt. It will make Spanish debt riskier for private investors. And it might make it harder for Spain to pay back its debts. It kicks the can at the expense of zombifying Spain's economy.

Here's the worst part. It's not even clear that the Eurocrats understand the mistakes they're making. If they did, they wouldn't keep repeating them, from Greece to Ireland to Portugal, and now Spain. They're running out of time. So are we.

Matthew O'Brien is a former senior associate editor at The Atlantic.