Posted 8 years ago

FOMC minutes and G7 meeting in focus - Weekly Markets Analysis

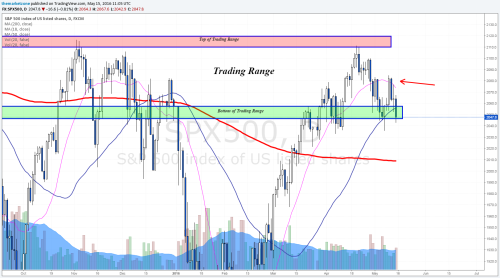

With $SPX dancing around the 2050 support zone and $DXY playing around the 94$ structure zone, there’s still no clear answer for where the markets are heading to in the near future.

Last week’s price action generated several bearish signals for stocks as, for example, $SPX closed below its 50 days MA line for the first time since it crossed above it on March 2016.

While stocks continue to crash after earnings reports (like $DIS and $WEN) and $AAPL with price levels that was seen last on 2014, you have to wonder when… what will cause $SPX to crack down and free fall into the 2000 support zone. Will it be the Sell In May myth? Perhaps we will be smarter by the end of next when investors and traders will digest the FOMC minutes and get tweets and leaks from the G7 meeting - Two events that will be in focus this week.

With such complex technical situation, you either have to be very careful with the trades you pick (read more) or focus on the longer term in order to avoid the daily/weekly volatility. For example, last week I posted this blog post about $SLV with longer term structure analysis that can be used for those who aren’t interested in the day to day noise.

Read more about this week’s analysis:

The Weekly Markets Analysis - Stocks Market - 15/5/16

The Weekly Markets Analysis - Forex Market - 15/5/16

Subscribe to my mailing list and make sure you don’t miss any of the MarketZone’s newsletters and Blog Posts - Subscribe here

1 Notes