Why You Need To Start Paying Attention To Your Loan Account Statement

Debt is part and parcel of life. It is hard to come across a person or an entity that has never been indebted in some way, either financially or in kind. As such, it is incredibly important that people pay attention to loan statements that act as evidence of their repayments.

Unfortunately, this is not the case. Because debt involves cash outflows, many people try to keep off their loan statements in a bid to avoiding the inevitable feeling of owing someone money. In short, people like to borrow money, but no one enjoys being indebted.

In fact, most people would rather only get notified when they have fully repaid their debt, which means they are less interested in the contents of the loan. Actually, according to a recent survey conducted in the UK, most people barely understand the items included in a loan—so they just pay up—anyway.

However, given the current market conditions and the changes in interest rates, it is important to investigate your loan statement thoroughly every time it comes out. After all, how would you know that your payments are actually on course to complete the repayment on time?

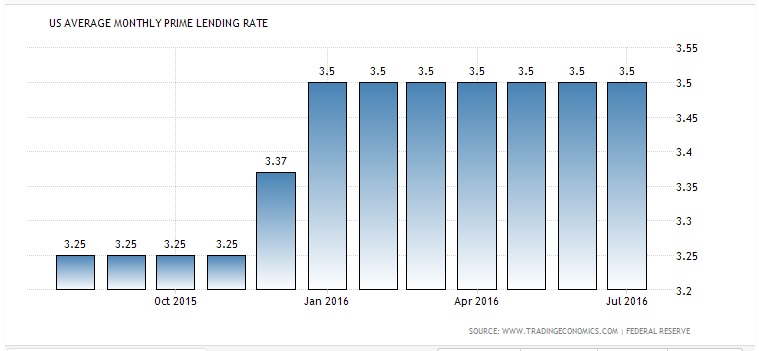

Changes in interest rates can affect the loan term unless you adjust your payments proportionately. In mid-December last year, the Federal Reserve hiked the base interest rate by 0.25 points to 0.50%. This resulted in an effective upward increment on the prime monthly lending rates of 0.125 points to 3.37% for the month. In January 2016, the prime monthly lending rate jumped to 3.50% from 3.25% in November 2015, reflecting the full impact of the 0.25% added in December.

These numbers suggest that the interest rate hike had a partial impact (50% of 0.25%) in December as compared to 100% impact in January 2016 onward. For people who do not pay close attention to their loan statements and have floating rate products, they are likely to experience increased interest expense charges on their repayments, thereby resulting in an extended repayment period if monthly payments are not adjusted accordingly.

As such, for those that make their loan repayments manually, they could end up ending the payments before they completely service their loans. This could then end up reflecting badly on their FICO credit scores thereby making it difficult for them get a loan in the future.

Right now, there is a lot of talk suggesting that we could see another rate hike by the end of the year. If this happens somewhere in the middle of a month, then that particular month would be affected partially leading to a partial increment on the monthly prime lending rate—while the following month onward—would experience the full effect.

In summary, it is important to pay a close attention to your loan account statements. Even if there is no significant change in interest rates, you can at least see where every cent in your bank account is going.

This can also help you to plan for future payments, in which case, you could actually come up with more efficient loan repayment plans that could end up saving you money. Some of the most common hybrid methods of loan repayments include expedited repayment methods such as increasing the amount paid per month, or making bi-monthly payments.

You cannot take advantage of such opportunities unless you choose first to keep track of your payments. Therefore, while the feeling of having to look at how much you owe your creditors every period may be abhorrent, the benefits can be as fulfilling. And with the Federal Reserve expected to tighten up the monetary policy again this year, it’s good to keep in touch so that you are not caught off-guard.

Disclosure: The material appearing on this article is based on data and information from sources I believe to be accurate and reliable. However, the material is not guaranteed as to accuracy nor ...

more