Panama Papers leaks: everything you need to know about offshore account revelations

Panama leaks: A massive leak coming from Mossack Fonseca of 11.5 million tax documents exposed secret offshore dealings

Panama Papers: An investigation by more than 100 media groups, described as one of the largest such probes in history, revealed the hidden offshore assets of around 140 political figures

What information has been released?

Emails, pdf files and other records from the internal database of Mossack Fonseca, a Panama-based law firm. They are said to cover a period from the 1970s to the spring of 2016.

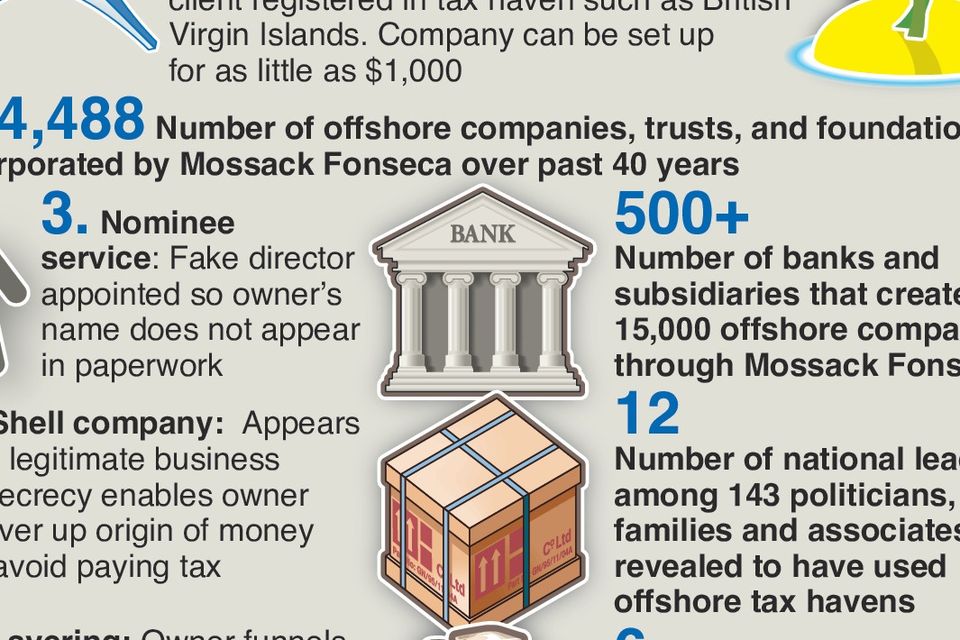

The so-called Panama Papers are said to provide data on around 214,000 offshore companies. The BBC alleges the documents show how the law firm has helped clients launder money, dodge sanctions and evade tax.

Mossack Fonseca said it had operated "beyond reproach" for 40 years and had never been charged with criminal wrongdoing.

Where has this data come from?

German newspaper Sueddeutsche Zeitung first received the data more than a year ago. It said the information was offered by an anonymous source who requested no cash compensation. It has been shared by the International Consortium of Investigative Journalists (ICIJ) to 107 media organisations including The Guardian and BBC's Panorama.

View of a sign outside the building where Panama-based Mossack Fonseca law firm offices are placed in Panama City on April 3, 2016. AFP/Getty Images

Who has been named in the documents?

More details are expected to be released in the coming days although the International Consortium of Investigative Journalists, based in Washington, said the offshore holdings of 12 current and former world leaders are detailed in the investigation.

It added criminals, celebrities, sports stars and businessmen are also included.

British Prime Minister David Cameron's father Ian was among the hundreds of individuals named in the the so-called Panama Papers leak of confidential documents. HMRC could not confirm whether or not the affairs of Blairmore Holdings would be investigated (Photo by Oli Scarff/Getty Images)

The ICIJ raised Baroness Sharples' involvement with the Bahamas-based company Nunswell Investments Limited to make investments, although noted she did not deal with Mossack Fonseca directly when managing her company.

Her lawyers told the ICIJ the company was registered in the UK in 2000 and now pays taxes to the British Government.

It added that the House of Lords "has been notified of Baroness Sharples' oversight in registering her interest as a director of Nunswell Investments Limited" and that she receives "no remuneration ... nor any income or capital from that company".

An investigation by more than 100 media groups, described as one of the largest such probes in history, revealed the hidden offshore assets of around 140 political figures, among them Gunnlaugsson. AFP/Getty Images

Mr Mates is said to have been linked with offshore companies used for real estate development in the Bahamas.

The former minister told the ICIJ he was asked by a friend to become chairman of Haylandale Limited, with his advice sought on issues including how to deal with the government of Antigua.

According to the ICIJ, Mr Mates said he had not and would not receive any remuneration "unless and until the development took place, nor were the shares of any value", as the company "never had any real value".

A populist Ukrainian party leader said on April 4, 2016 he would launch impeachment proceedings against President Petro Poroshenko over his use of offshore accounts revealed by the "Panama Papers" leak. AFP/Getty Images [File photo]

Iceland's prime minister Sigmundur David Gunnlaugsson has been questioned about claims that he failed to declare an interest in his country's bailed out banks. He is facing calls for his resignation.

According to analysis, as much as 2 billion dollars (£1.4 billion) has been secretly shuffled through banks and shadow companies linked to Russian president Vladimir Putin's associates. The Kremlin denied the president was connected to any wrongdoing and claimed he was the target of a smear operation.

What is the difference between tax avoidance and tax evasion?

The moment Iceland’s prime minister walked out of an interview because of a tax haven question #panamapapershttps://t.co/FfWj8jiQec

— The Guardian (@guardian) April 4, 2016

Panama Papers: Thousands of Icelanders protest, call on PM to resign https://t.co/IFSl6Cczje

— FRANCE 24 English (@France24_en) April 5, 2016

Tax avoidance involves companies and people using legal ways and following the rules to reduce their tax bill, which on a small scale can include using a tax-free Isa to save money.

In contrast, tax evasion is an offence and involves illegal ways of paying less tax than required.

It is claimed the leaked papers show attempts to use offshore companies to conceal the identities of the actual company owners.

President Francois Hollande promised Monday that French tax authorities will investigate the disclosures of the Panama Papers and that legal proceedings will follow. AFP/Getty Images. [File photo]

What is the UK's approach to dealing with tax havens?

The Government announced last year that Britain's overseas territories - which include the Cayman Islands and the British Virgin Islands - had agreed to reveal who owns and profits from a company on central registers or "similarly effective systems".

The Foreign Office says it wants UK law enforcement and tax authorities to have unrestricted access to this information while companies and their beneficial owners must not be alerted should an investigation be under way.

All information on the biggest data-leak: https://t.co/KsSuPDHG3F #panamapapershttps://t.co/Glg7u0LnQl

— Süddeutsche Zeitung (@SZ) April 3, 2016

But campaigners argue this falls short of the desire to have increased transparency, including David Cameron's previously stated intentions for such registers to be publicly available.

The Prime Minister is facing demands to increase the pressure on the overseas territories ahead of an international anti-corruption summit in London next month.

What is David Cameron's late father's link to the Panama papers?

Iceland's prime minister Sigmundur David Gunnlaugsson, right, gives a statement over the Panama Papers (AP)

According to the ICIJ, Ian Cameron helped create and develop Blairmore Holdings Inc. in Panama in 1982 and was involved in the investment fund until his death in 2010.

In July 1998, the fund was valued at nearly 20 million US dollars and promotional literature noted it was "not liable to taxation on its income or capital gains" and that the fund "will not be subject to United Kingdom corporation tax or income tax on its profits".

Blairmore used a large amount of bearer shares - unregistered shares that belong to anyone who physically holds the share certificates - until 2006.

The Mossack Fonseca law firm in Panama City, which said to have had more than 11 million documents leaked on the financial dealings of the rich and famous (AP)

Downing Street said it was a "private matter" whether the Cameron family still had funds in offshore investments. There is no suggestion that this avoidance arrangement or others exposed by the leak were anything but entirely legal or that Mr Cameron's family did not pay the UK tax due on any repatriated assets.

Jurgen Mossack and Ramón Fonseca - the lawyers whose firm is at the centre of global controversy

John le Carre’s 1996 novel, The Tailor of Panama, tells the story of Harry Pendel, a British tailor who serves the great and good but whose refusal to come clean about his past almost leads to his downfall. In Panama, he believes, discretion is the only way.

For more than four decades, the law firm Mossack Fonseca - whose twisting saga may even have been beyond the imagination of le Carre - has adopted a similar strategy of discretion and survival.

If the documents obtained and analysed by the International Consortium of Investigative Journalists (ICIJ) are to be believed, the firm that has its headquarters not far from those of the fictional Harry Pendel, has had financial dealing with a total of 128 politicians and public officials around the world. The company has denied any wrongdoing.

The ICIJ says the documents provide an insight into the financial affairs of 12 current and former world leaders. (By contrast, Harry Pendel made suits for just three presidents.)

The company was formed in 1977 by Jurgen Mossack and Ramón Fonseca, and specialises in commercial law, trust services, investor advisory and international structures. Its website says it can help reduce costs, incorporate and manage Private Interest Foundations, conduct business in any country and carry out transactions in any chosen currency.

In a boast that may seem ironic given the massive leak of documents, its website says offices are supported by “secure, state-of-the-art technology that is upgraded continually”.

The ICIJ says that Mr Mossack is a German immigrant whose father sought a new life in Panama for his family after serving in Hitler’s Waffen-SS during World War II. The elder Mossack also offered to spy for the US government on “former Nazis turned Communist or unconverted Nazis cloaking themselves as Communists,” after the war, according to US intelligence files obtained by the ICIJ.

Read more

Read more

Jurgen Mossack studied at the Santa Maria La Antigua University School of Law in Panama.

Mr Fonseca is an award-winning novelist who has worked in recent years as an adviser to Panama’s president, it said.

The consortium said from its base in Panama City, the company has created and established anonymous companies in Panama, the British Virgin Islands and other financial havens.

“The law firm has worked closely with big banks and big law firms in places like The Netherlands, Mexico, the United States and Switzerland, helping clients move money or slash their tax bills, the secret records show,” the ICIJ said.

“An ICIJ analysis of the leaked files found that more than 500 banks, their subsidiaries and branches have worked with Mossack Fonseca since the 1970s to help clients manage offshore companies."

Join the Belfast Telegraph WhatsApp channel

Stay up to date with some of Northern Ireland's biggest stories

![A populist Ukrainian party leader said on April 4, 2016 he would launch impeachment proceedings against President Petro Poroshenko over his use of offshore accounts revealed by the "Panama Papers" leak. AFP/Getty Images [File photo]](https://focus.belfasttelegraph.co.uk/thumbor/co5j4uBjDCEMSUKokaqeoCfMde0=/0x0:1500x1169/fit-in/960x640/prod-mh-ireland/retr_e067b756-9967-11ed-8700-0210609a3fe2.jpg)

![President Francois Hollande promised Monday that French tax authorities will investigate the disclosures of the Panama Papers and that legal proceedings will follow. AFP/Getty Images. [File photo]](https://focus.belfasttelegraph.co.uk/thumbor/PsQSindkrKRzQiaPTI7_WxF8cD0=/0x0:1500x1220/fit-in/960x640/prod-mh-ireland/retr_e067c05c-9967-11ed-b466-0210609a3fe2.jpg)