So Chinese currency manipulation is starting to get the heat it deserves. Good.

But, um, what’s this about?

Exchange rates are an arcane subject, harder to explain than a meeting with the Dalai Lama.

Gah. The renminbi thing isn’t at all hard to explain — it’s just supply and demand. Here:

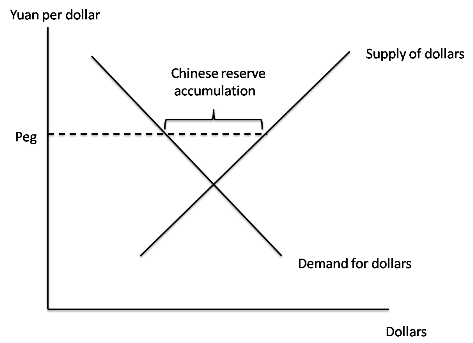

The more depreciated China’s exchange rate — the higher the price of the dollar in yuan* — the more dollars China earns from exports, and the fewer dollars it spends on imports. (Capital flows complicate the story a bit, but don’t change it in any fundamental way). By keeping its current artificially weak — a higher price of dollars in terms of yuan — China generates a dollar surplus; this means that the Chinese government has to buy up the excess dollars. There’s nothing arcane about it.

Nor is there anything arcane about the implications: In the current environment, with high unemployment around the world and policy interest rates as low as they can go, this is a predatory, beggar-thy-neighbor policy.

*Renminbi is the name of the currency; yuan is the unit. Think of sterling and the pound.