Unsolicited Contribution to Code of Conduct for Jamaican Banking Sector

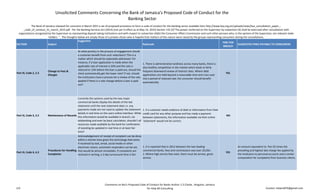

- 1. SECTION Subject Suggestion Rationale FINE FOR BREACH SUGGESTED FINES PAYABLE TO CONSUMERS Part III, Code 2, 2.3 Change to Fees & Charges At what point(s) in the process of engagement should a customer benefit from such reductions? This is a matter which should be separately addressed. For instance, if a loan application is made when the applicable rate of interest is 20% and the rate is reduced to 15% before the loan is paid out, should the client automatically get the lower rate? If not, should the institutions have a process for a review of the rate applied if there is a rate change before a loan is paid out? 1. There is administrative tardiness across many banks, there is also healthy competition in the market which leads to fairly frequent downward review of interest rates. Where debt applications are held beyond a reasonable time and cross over into a period of reduced rate, the consumer should benefit- automatically. YES Part III, Code 3, 3.2 Maintenance of Records Currently the systems used by the two major commercial banks display the details of the last statement until the next statement date i.e. any payments made are not used to update the statement details in real time on the users online interface. While this information would be available in branch, via telebanking and even by basic calculation, shouldn't all resources made available by the bank for confimation of standing be updated in real time or at least fair time? 1. If a customer needs evidence of debt or information from their credit card for any other purpose and has made a payment between statements, the information available via their online 'statement' would not be correct. NO Part III, Code 4, 4.3 Procedures for Handling Complaints Acknowledgement of receipt of complaint can be done within a shorter time given the technology that exists. If receiived by text, email, social media or other electronic means, automatic responders can be set; that would be almost immediate. If complaints are received in writing, a 3 day turnaround time is fair. 1. It is reported that in 2012 between the two leading commercial banks, fees and commissions was over J$12bil . 2. Where high service fees exist, there must be service, great service. YES An amount equivalent to five (5) times the prevailing and highest late charge fee applied by the institution to personal accounts and a similar computation for complaints from business clients. Unsolicited Comments Concerning the Bank of Jamaica's Proposed Code of Conduct for the Banking Sector The Bank of Jamaica released for comment in March 2015 a set of proposed provisions to form a code of conduct for the banking sector available here http://www.boj.org.jm/uploads/news/bsa_consultation_paper_- _code_of_conduct_31_march_2015.pdf . Per the Banking Services Act (2014) (not yet in effect as at May 14, 2015) Section 132 (5)"The power conferred on the Supervisor by subsection (4) shall be exercised after consultation with organizations recognized by the Supervisor as representing deposit taking institutions and with respect to subsection (4)(b) the Consumer Affairs Commission and such other persons who, in the opinion of the Supervisor, are relevant stake holders. " . The thoughts below are simply those of a private citizen who is hopeful that matters of this nature were raised by the groups representing consumers during the consultations. 1/4 Comments on BoJ's Proposed Code of Conduct for Banks Author: C.E.Clarke , Kingston, Jamaica for Help Mi Consulting Contact: helpmi876@gmail.com

- 2. Part III, Code 4, 4.3 Procedures for Handling Complaints The BoJ should set a minimum standard for the initial response. The operations of banks for the most part is automated. Investigating complaints does not have to be 30 day process. Perhaps the BoJ can assist by identifying the more common types of complaints and providing acceptable response times for each and fines for breaches. 1. It cannot be left to the institutons to determine response times. There are some complaints that can literally put the life of a complainant on hold e.g. not having access to accounts. YES An amount equivalent to ten (10) times the prevailing and highest late charge fee applied by the institution to personal accounts and a similar computation for complaints from business clients. Part III, Code 6 Advertisements The BoJ should further mandate the institutions to practice proper marketing management, specifically to ensure posters, online banners and all other materials relating to old promotions, which are still within their control, are removed once they become obsolete. 1. Customers can be mislead by obsolete promotional material made available by the institutions, irrespective of the fact that a 'deadline' or 'end date' may exist in fine print. The institutions should be forced to manage their marketing tools and make only current information available to clients and prospective clients. YES An amount which covers all reasonable expenses incurred by the customer in trying to conduct business on the basis of the obsolete information, where the customer is able to show that the information was made available by the institution at a date subsequent to the 'end date' OR a formal letter of apology to the customer with the guarantee that the misleading material has been removed. Part III, Code 6 New- Marketing & Management The BoJ should include a provision for DTIs to ensure correct and complete contact details are maintained at all points of customer contact- online directory, company website etc 1. Some companies have obsolete contact details including telephone and fax numbers available on their website. This can cause unnecessary delays if a customer should for instance be asked to send a fax and use the information from the website. 2. If no other sector can afford proper website and public image maintenance, the banking sector can. YES An amount which covers all reasonable expenses incurred by the customer in trying to conduct business on the basis of the obsolete information, where the customer is able to show that the information was made available by the institution at a date subsequent to the 'end date' OR a formal letter of apology to the customer with the guarantee that the misleading material has been removed. NEW Acceptance of Documents / Confirmation of Engagement Where a A DTI accepts documents from a customer for the purpose of conducting business but where such business will not or cannot be concluded within the same day, the customer must be issued with receipt confirming the business started and the documents collected. The same should apply where documents are not involved but where the DTI has accepted the interest of a person in conducting business with them e.g. where no submission of documents is required but where a person has signed documents to start a process. 1. The absence of a receipt leaves room for the institutions to delay applications on the false basis of documents not being submitted 2. Where the business is not successful and documents are to be returned to the client, lost items could be costly for the client to replace e.g. titles, photographs etc. 3. It is only fair for a person to have evidence of business started. Consider someone who is working with an institution to consolidate a loan, that person has nothing to use as evidence to the creditors involved that a process is underway. YES Where documents are lost, an amount equivalent to five (5) times the replacement cost 2. failure to provide receipt, an amount equivalent to five (5) times the highest late fee charged on personal account where individuals are involved and the five (5) times the highest rate charged as late fee on business accounts where the breach is related to a business account. 2/4 Comments on BoJ's Proposed Code of Conduct for Banks Author: C.E.Clarke , Kingston, Jamaica for Help Mi Consulting Contact: helpmi876@gmail.com

- 3. NEW Completion of Applications Where an institution uses a system where the officer asks questions of the customer and completes the application electronically, such applications should be printed or made available electronically for the applicant to review. Where customers are not involved in the preparation of their own application documents and an officer on their own account chooses to carry out an unlawful or unethical offence concerning information on the person's application, the customer could unnecessarily become party to an investigation or may suffer undue consequences along the way e.g. comparable information varying on a credit report YES An amount which reasonably compensates for any embarrassment, lost opportunity, emotional distress or other reasonable costs to be determined by arbitration managed by the Supervisor NEW Service Turnaround Time Following on the above suggestion for the use of a document to confirm engagement, said document should also state the turnaround time for the specific service e.g. for a loan secured by car -2 weeks, unsecured -1 week, secured by mortgage-4 weeks etc. While banks may have their internal deadlines, these are not communicated to the consumers in any binding way which leaves room for delays and uncertainty. Just about every transaction with a bank will include the accrual of or the earning of interest, both are important to the financial affairs of a consumer so every effort should be made to keep service delivery within a reasonable and known period. YES 1. Where timelines are not met for services where a processing or service fee has been applied, said fees are to be waived or in the case of a credit application, paid to the principal of the loan balance once the loan is finalized. 2. Where the breach causes a loss of potential interest the customer/ customer's account is to be compensated in the amount of the loss. 3. Where the delay causes significant and negative changes in the financial standing of the affected person, compensation is to be determined by arbitration. NEW Service Turnaround Time Following on the above suggestion for the use of a document to confirm engagement, said document should also state the turnaround time for the specific service e.g. for a loan secured by car -2 weeks, unsecured -1 week, secured by mortgage-4 weeks etc. While banks may have their internal deadlines, these are not communicated to the consumers in any binding way which leaves room for delays and uncertainty. Just about every transaction with a bank will include the accrual of or the earning of interest, both are important to the financial affairs of a consumer so every effort should be made to keep service delivery within a reasonable and known period. YES 1. Where timelines are not met for services where a processing or service fee has been applied, said fees are to be waived or in the case of a credit application, paid to the principal of the loan balance once the loan is finalized. 2. Where the breach causes a loss of potential interest the customer/ customer's account is to be compensated in the amount of the loss. 3. Where the delay causes significant and negative changes in the financial standing of the affected person, compensation is to be determined by arbitration. 3/4 Comments on BoJ's Proposed Code of Conduct for Banks Author: C.E.Clarke , Kingston, Jamaica for Help Mi Consulting Contact: helpmi876@gmail.com

- 4. NEW New- Staffing DTIs and in particular their loan departments are to be adequately staffed to match the anticipated response of their marketing efforts and competitive rates. 1. the ratio of staff could be plugged to the value of each branch's loan portfolio OR 2. by looking at the average exhaust time for loan matters across all DTIs and determining a 'fair' exhaust time, taking an average number of weekly traffic , then ensuring there is adequate staff to service the expected traffic at a determined minimum exhaust/processing time and an 'acceptable' waiting period. 3. Establish an appointment system A trip to the bank/other financial institution for the average consumer is often comparable to a trip to a public health center or hospital; the wait is long, only you may not be as miserable as the temperature is usually nicely regulated and there is usually at least one person to acknowledge your wait time "Yuh nuh get tru yet?" or 'someone will soon be with you' at least four times in an hour and a half. It seems the trend is to have one or two officers in a loan department but with a market that seems to be surviving only on loan products, that is not satisfactory. Given the maturity of the financial sector, processes must become more efficient, not just to ensure higher profits but to make the experiences more pleasant and practical for consumers whose good and bad decisions help DTIs thrive. YES 1. Penalties as laid down in the relavent Act 2. Compensation for the consumer where the determined minimum exhaust/processing time and or waiting time goes beyond an 'unreasonable' overage Author: C.E.Clarke for Help Mi Consulting , May 15, 2015 Contact: helpmiconsulting@gmail.com 4/4 Comments on BoJ's Proposed Code of Conduct for Banks Author: C.E.Clarke , Kingston, Jamaica for Help Mi Consulting Contact: helpmi876@gmail.com