Posted 8 years ago

Fed’s week and the Year End Rally

Draghi and China set the stage.. Investors bought VIP seats..and now it is all up to Yellen to deliver!

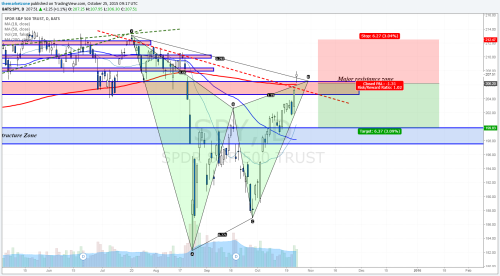

Will the Year End Rally, that started as I predicted, near 1900 in $SPX, continue towards new record highs? Or.. what started earlier this year, will end earlier also and $SPX will launch wave 3 that will lead to 2000 again and perhaps even lower by the end of the year.

$SPX/$SPY reached my final target levels as they completed their bearish harmonic patterns:

Naturally, when we have stocks near or above record highs, this week’s Stocks newsletter is focused on bearish opportunities that offer great R/R if sentiment will indeed change back to bearish this week.

$AMZN is a great example of a stock that exploded higher last week and reached my final bullish target level, generating more than 10% gains, only to complete a bearish harmonic pattern.. and there are other setups inside.

On the other hand, $YHOO, that moved exactly as planned last week, also generated nice profits on earnings, looks like on the verge of a major breakout if sentiment will remain bullish.

On the FX market, no doubt that last week’s biggest story was the ECB’s press conference where Draghi implied that the ECB may consider more stimulus actions on December’s meeting, what turned out to be a devastating statement for the EUR.

The focus now shifts to the USD that took a blow on last FOMC meeting. If the Fed will continue to hesitate with the rate hike, USD may suffer another blow that will lead to a rally in the majors. I definitely see this option reflected in the charts.

In this week’s FX edition you’ll find analysis for $EURUSD, $AUDUSD and also special Harmonic Trade Analysis on $EURAUD

It is going to be an interesting week.. keep open mind and monitor all options.

Press the buttons below to read October’s 25th Weekly Markets Analysis newsletters:

3 Notes