Trend update: Is the executive pay gap as big as the press makes out it is?

Business leaders themselves say that rising executive pay is justified by the increasing (over the long-term at least) value of the stock markets, while the media laments the growing divide between the rich and the poor

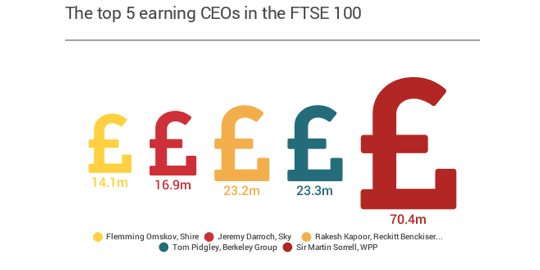

For the top 10 paying FTSE 100 companies that have published their remuneration reports for 2015, the average pay for a CEO more than doubled to £17.7m over the last year, according to research from The Guardian.

For the average worker in the UK, the average salary stands at just over £26,000, an increase of 2.5% over the last 12 months. Quite a stark difference, indeed.

If you take a look outside the biggest companies in the country, however, the average pay for a CEO currently stands at £99,000.

But while the likes of BP’s revolt against Bob Dudley’s 20% pay increase after reporting a record net loss and thousands of job losses have hit the headlines, the truth is that shareholders have not made as many objections to this as the press may have you believe.

So far in 2016, 4% of FTSE 100 companies have received less than 50% support for their remuneration packages, just one percentage point higher than 2015’s 3%, according to research from Towers Watson.

For the FTSE 350, the percentage of companies receiving less than 50% has actually fallen, dropping four percentage points to just 1% so far in 2016.

Meanwhile, the proportion of companies in the FTSE 100 receiving 90%-100% support stands at 73% for 2015, compared to 79% in 2015. In the FTSE 350, the proportion of companies receiving the highest level of support has fallen from 80% to 78%.

While there are still companies to report their remuneration outcomes for 2016, this is not exactly evidence of growing shareholder discontent at the levels of executive pay.

It is also worth noting that a high proportion of these remuneration packages are tied up in long-term incentive plans linked to company success.

Research from Deloitte conducted in 2015, Directors remuneration in FTSE 100 companies¸ found that almost 60% of FTSE 100 companies have incentive plans with time horizons longer than three years, compared to just 50% in the previous year.

But with the recent vote for Brexit revealing a deep divide between the established business view and the average man or woman on the street, remuneration committees may want to start listening to the general public when it comes to what they pay their top executives.

This article was written by Matt Scott, REBA's tame actuary.

He safeguards the reward community from hours of online research, his superstrength is delivering the numerical proof you need to make your reward business case.